- Official Post

Local Overview

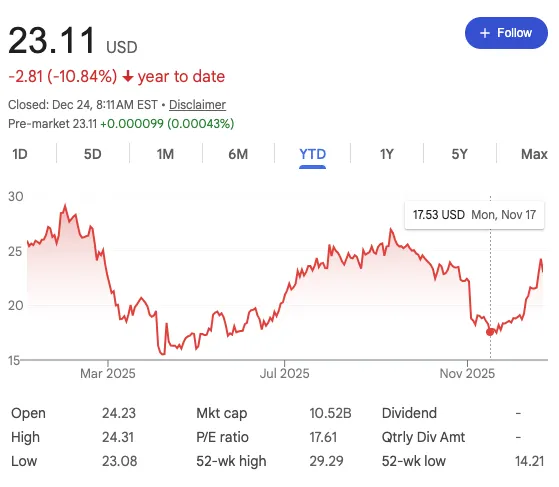

I did a review of sectors that appear to be down mid-November with my State of the Stock Market - November post to generate some ideas for future investments. NCLH appeared on my radar at that point. Open instagram, and you'll see friends and family going on cruises towards Belize and the Caribbean. Looks like there are several companies that operate these cruises including CCL, RCL, and NCLH.

Financials

According to Yahoo...

Quote

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. It operates the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands.

The stock itself is volatile with a beta of 2.12. The P/E Ratio is decent at 16.63 and EPS is 1.39 @TOP. Historically though, going back to pre-covid times. The stock peaked at 60 dollars but appears to have had trouble recovering the past several years. The only positive to note is that this appears to be a seasonal business. This stability would allow for predictable entry points for any investor.

Entry Point

For the year, NCLH is -10.84% if you can get in at the lowest point, then the upside could be approx. 80-90%

The closes lowest point being $17.69 on November 17th.

Closing Notes

At the low cost of $23 bucks, Norwegian Cruise Line Holdings appears to be an affordable option for a value investor looking to enter the market. If one can time the dip and the peak, there is money to be made!