Local Overview

Anywhere you go in town, there's a construction crew tearing up the streets that mayor turner may or may not have repaired. Mayor Whitmire has his hands full with the budget crisis at the moment, but that's neither here nor there. We're here to talk big demolition construction machines.

Financials

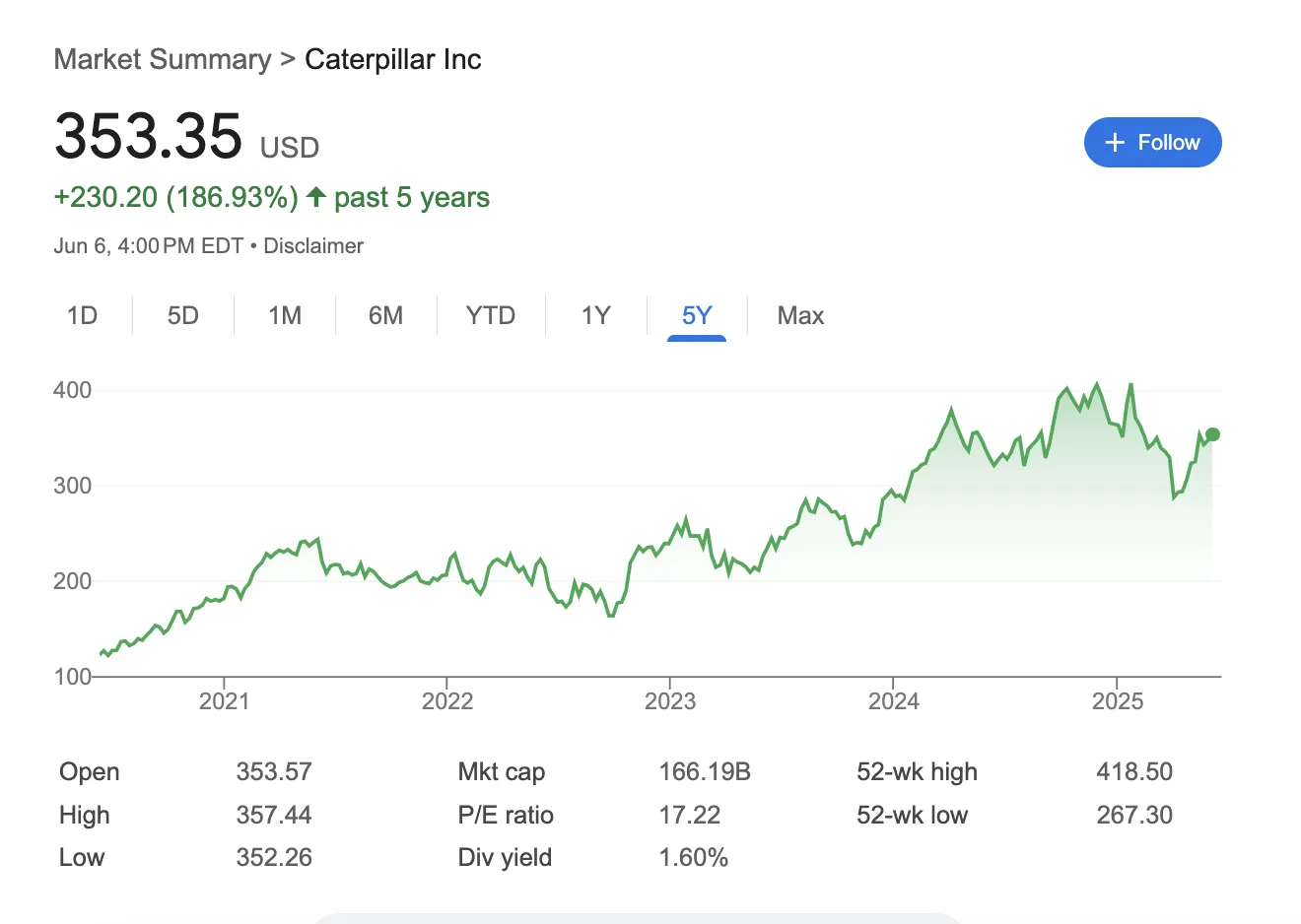

Caterpillar over the past five years has produced a 186% return on it's stock price. They manufacture and sell construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally. For more information, check out Yahoo Finance.

The PE ratio is 17.24 and the EPS is 20.49 @ post. Nothing much to say right now other than open insider shares, a mixed story about insider sentiment towards the company. It's interesting to see that at the beginning of the pandemic, both CAT and DE had an uptick in stock price. I wonder if it has to do with infrastructure project across the US. For the next few posts, I might look at some Infrastructure ETFs such as FII, IFRA, NFA, IGF, PAVE.

---

Post Your Thoughts about CAT on the Forum @Money Game